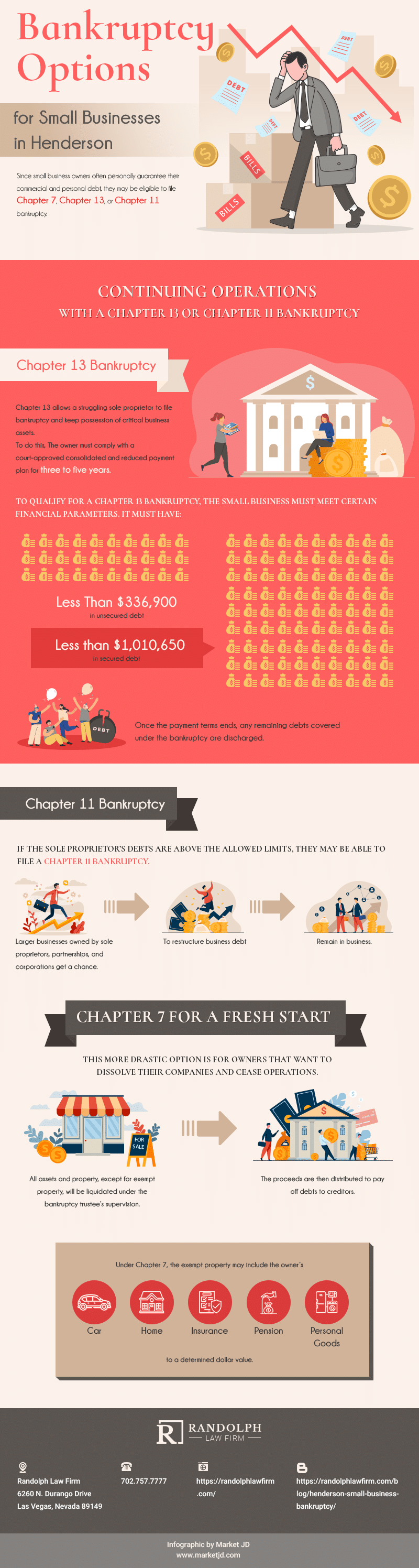

Bankruptcy Options for Small Businesses in Henderson

Because many small businesses are unincorporated, sole proprietors and entrepreneurs in Nevada are afforded bankruptcy options that larger, incorporated businesses are not. Small business owners often personally guarantee their commercial and personal debt, so they may be eligible to file Chapter 7, Chapter 13, or Chapter 11 bankruptcy.

(Article continues below infographic)

________

Continuing Operations with a Chapter 13 or Chapter 11 Bankruptcy

It may be possible for

To qualify for a Chapter 13 bankruptcy, the small business must meet certain financial parameters. It must have less than $336,900 in unsecured debt and less than $1,010,650 in secured debt. These limits are subject to change in the future. If the sole proprietor’s debts are above the allowed limits, he or she may be able to file a Chapter 11 bankruptcy that allows larger businesses owned by sole proprietors, partnerships, and corporations to restructure business debt and remain in business.

Chapter 7 for a Fresh Start

Filing for Chapter 7 is

The upside to filing a Chapter 7 bankruptcy is that the debtor gets a clean slate and can walk away from a business that has no hope of turning its path around. However, some debt cannot be wiped out through any type of bankruptcy. Debt like some back taxes and penalties, child support, alimony, college loans, and criminal restitution, court fines or penalties will not be eliminated by filing either a Chapter 7, Chapter 13, or Chapter 11 bankruptcy. Bankruptcy filers will need to continue paying these obligations.